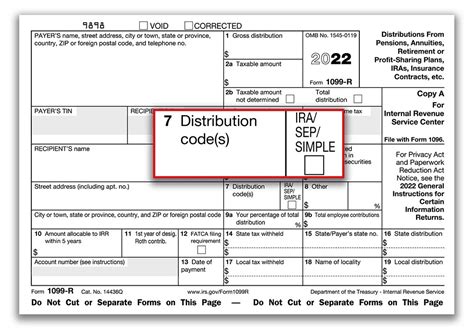

1099 r box 7 distribution code g The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

Insulation Materials: Inside the box, various insulating materials protect wires and connections from moisture and contaminants. Insulation also helps keep the box cool, which is crucial for high-load environments where components might overheat.

0 · what does code 7d mean

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099r box 7 code 8

5 · 1099 r distribution code m2

6 · 1099 r distribution code e

7 · 1099 distribution code 7d

Crafting with metal can seem a bit intimidating at first, but there is SO MUCH that you can make! The upcycle projects are pretty much limitless with a little bit of creativity. Get artistic and crafty or make something practical for your home.

What is distribution code "G" in box 7 on 1099-R? Yes, the Form 1099-R must be entered into TurboTax. The box 1 amount will appear on Form 1040 line 5a but the zero amount in box 2a means that none of this will be included in the taxable amount on line 5b.What is distribution code "G" in box 7 on 1099-R? Yes, the Form 1099-R must be .May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as .About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; .

We would like to show you a description here but the site won’t allow us.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to . Use Code G for a direct rollover from a qualified plan, a section 403 (b) plan or a .

base metal fabrication suppliers

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 . Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan. Also use when non-Roth QRP .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include . However if you skipped the traditional IRA rollover and converted it to the ROTH directly then you will need to use a code 7 in the box 7 of the 1099-R and NOT the code G. What is distribution code "G" in box 7 on 1099-R? Yes, the Form 1099-R must be entered into TurboTax. The box 1 amount will appear on Form 1040 line 5a but the zero amount in box 2a means that none of this will be included in the taxable amount on line 5b.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7.

Use Code G for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible retirement plan (another qualified plan, a section 403 (b) plan, a governmental section 457 (b) plan, or an IRA). See Direct Rollovers in the IRS instructions for Form 1099-R for more information.

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan. Also use when non-Roth QRP assets are directly rolled over to an IRA, and for in-plan Roth rollovers that are direct rollovers.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include applicable earnings, these are included in the 1099-R amounts.. Code A: .

However if you skipped the traditional IRA rollover and converted it to the ROTH directly then you will need to use a code 7 in the box 7 of the 1099-R and NOT the code G. What is distribution code "G" in box 7 on 1099-R? Yes, the Form 1099-R must be entered into TurboTax. The box 1 amount will appear on Form 1040 line 5a but the zero amount in box 2a means that none of this will be included in the taxable amount on line 5b.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7.

Use Code G for a direct rollover from a qualified plan, a section 403 (b) plan or a governmental section 457 (b) plan to an eligible retirement plan (another qualified plan, a section 403 (b) plan, a governmental section 457 (b) plan, or an IRA). See Direct Rollovers in the IRS instructions for Form 1099-R for more information.1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.

Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan. Also use when non-Roth QRP assets are directly rolled over to an IRA, and for in-plan Roth rollovers that are direct rollovers.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include applicable earnings, these are included in the 1099-R amounts.. Code A: .

what does code 7d mean

However, if you need a tough metal tool box that you can keep for a very long time and carry your necessities, this is a great choice. Craftsman 2000 Rolling Tool Cabinet (Great General Purpose Rolling Tool Box Cabinet)

1099 r box 7 distribution code g|distribution code 7 normal