1099r distribution box 7 codes Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Western Cabinet Doors is Arizona’s largest and oldest cabinet door manufacturer, proudly serving cabinet shops and makers across the U.S. since 1980. With over four decades of experience, we specialize in producing high-quality, custom cabinet doors. Now with Online Ordering!

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

In this article, we will explore the main parts of a CNC machine and explain the CNC block diagram in simple terms. 7 Key Components of a CNC Machine 1. Machine Control Unit (MCU) The Machine Control Unit is the brain of the CNC machine.

irs distribution code 7 meaning

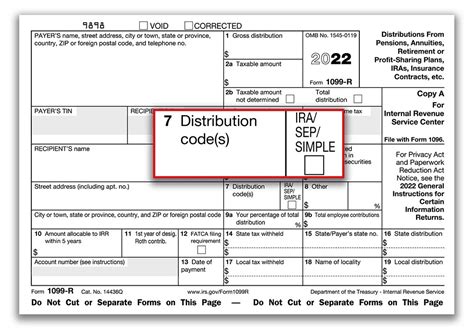

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 .

metal lunch box pencil case

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .These distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here.

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

The image below highlights the 1099-R boxes most frequently used—and their explanations—for defined contribution plan distributions. The following chart provides the . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .These distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 (with Code B, if applicable) to designate the distribution and the year it is taxable.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). The image below highlights the 1099-R boxes most frequently used—and their explanations—for defined contribution plan distributions. The following chart provides the distribution codes for Box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution.

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax returnIf a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .These distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 (with Code B, if applicable) to designate the distribution and the year it is taxable.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here.

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). The image below highlights the 1099-R boxes most frequently used—and their explanations—for defined contribution plan distributions. The following chart provides the distribution codes for Box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

irs 1099 box 7 codes

form 1099 box 7 codes

metal lunch boxes canada

1099 r minimum reporting amount

$24.98

1099r distribution box 7 codes|1099 r distribution codes 7d